Mobile money has become an essential part of Uganda’s financial landscape, with 66% of the population—about 34 million people—using these services.

However, high transaction fees, unreliable networks, and limited microtransaction options remain challenges.

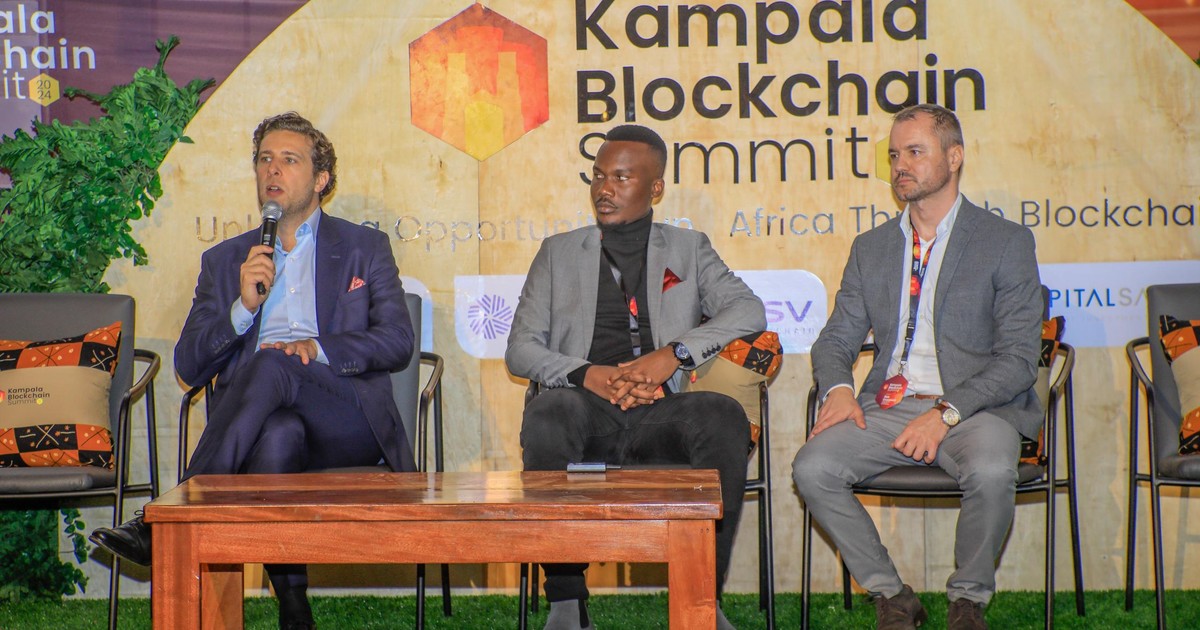

Thomas Giacomo, Director of Utilisation at BSV Blockchain, highlighted how blockchain technology could address these issues.

“Our blockchain system can handle up to one million transactions per second. By providing open-source components free of charge, we aim to empower Ugandan businesses and governments to revolutionise mobile payments,” he explained.

Giacomo added that blockchain could enable lower transaction costs, offline payments, and microtransactions, paving the way for a more efficient and inclusive financial system.

“You are far more advanced in mobile money here than in Europe, and blockchain could be the next iteration of this system,” he noted.

Gyewava Jonathan Kasule, Project Lead at Kite Pesa Uganda, echoed these sentiments, stressing the urgent need for better financial solutions.

“Imagine sending as little as 10 shillings. With blockchain, microtransactions become a reality, and we can move money at the speed of the internet,” Kasule said.

He emphasised the technology’s potential to overcome existing barriers and unlock new business models, thereby promoting financial inclusion across the country.

Broader blockchain opportunities

Reginald Tumusiime, President of BAU, underscored the significance of preparing Uganda’s youth for a rapidly evolving technological landscape.

“This summit is about equipping our young people for a world that is changing at lightning speed. With Sub-Saharan Africa’s working population projected to form over 25% of the global workforce in the coming decades, we must act now,” Tumusiime stated, calling for a mindset shift to embrace technology and productivity.

Olivier Fines, Global Head of Advocacy and Policy Research (EMEA) at the CFA Institute, delivered the keynote presentation, focusing on tokenisation as a key application of blockchain beyond cryptocurrencies.

“By automating processes, reducing costs, and improving efficiency, blockchain can revolutionise financial markets. Tokenisation remains a significant opportunity despite challenges like cybersecurity and data privacy,” Fines explained.

He also clarified that while Bitcoin often dominates media coverage, the real drivers of blockchain’s economic impact are smart contract-enabled coins, which facilitate automation and tokenisation.

Regulatory and Security Considerations

The summit also addressed regulatory challenges and security concerns associated with blockchain. Sherifah Tumusiime from the Financial Intelligence Authority (FIA) emphasised the need for vigilance.

“We support blockchain’s potential but must remain cautious. Virtual assets can attract foreign criminals, and we have to ensure Ugandans transact safely,” she stated.

The FIA is preparing a comprehensive risk assessment to identify vulnerabilities in the system.

Andrew Kawere, Acting Director for National Payment Systems at the Bank of Uganda (BOU), acknowledged the disruptive nature of blockchain.

“This technology is still young but full of promise. We need to understand it and responsibly harness its benefits,” Kawere remarked.

Opportunities in Capital Markets

Josephine Okui, CEO of the Capital Markets Authority, outlined the potential for blockchain in trade settlements.

“Blockchain can accelerate transactions, minimise counterparty risks, and improve security,” she noted, though she admitted that regulatory bodies still need to build internal capacity to manage these emerging technologies effectively.

Source link

The Impalaa Reports Impalaa is your biggest news source in Uganda and the East African region, bringing breaking news, daily updates, and the latest stories from Uganda.

The Impalaa Reports Impalaa is your biggest news source in Uganda and the East African region, bringing breaking news, daily updates, and the latest stories from Uganda.