By Frank Kamuntu

Investing is both an art and a science, a delicate balance between risk and reward, analysis and intuition. At its core, investing is about allocating resources to generate profitable returns over time.

But what truly defines a good investor? Is it the size of their portfolio or the ability to predict market movements accurately? While these aspects are important, the essence of a good investor goes beyond mere numbers.

It encompasses a set of traits, strategies, and a particular mindset that distinguishes the exceptional from the ordinary, notes Grid Capital Incorporated.

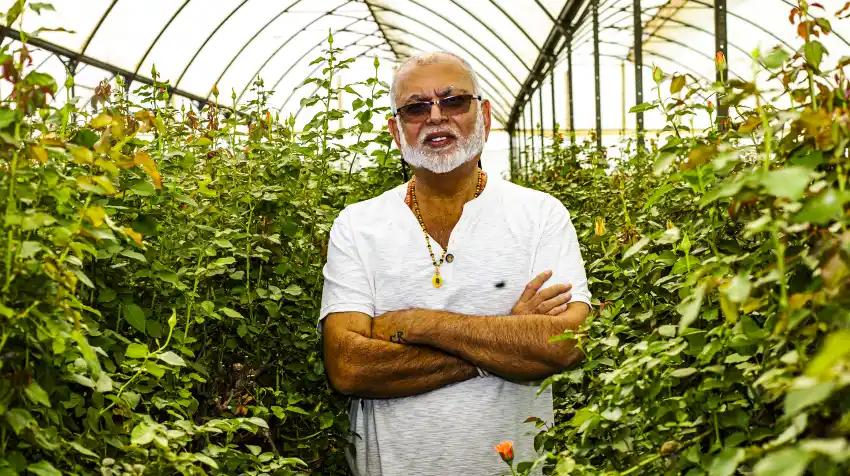

Ugandan businessman Sudhir Ruparelia is considered one of the richest in East Africa by Forbes. He is the chairman and majority shareholder in the Ruparelia Group of companies. His investments are mainly in banking, insurance, education, media, real estate, floriculture, and tourism sectors.

His business diversification also has Sudhir investing in the Uganda Securities Exchange (USE) where he buys shares in profitable companies, but also was able to start his own Crane Bank Limited, although regulation issues brought it down unfairly.

As a young man in England, Ruparelia successfully established several small businesses before returning to Uganda in the 1980s to take advantage of the improving political and business stability.

In Uganda Sudhir started Ruparelia Group as a small trading firm in 1985 at 29 years of age with $25,000 he returned with as savings accumulated from several jobs in the UK where his family had sought asylum after expulsion of Indians from Uganda.

From this humble beginning, Sudhir is known for running serious businesses such as Speaker Resort Munyonyo, Kabira Country Club, now under expansion, Speke Apartments, and Kingdom Kampala, and has acquired buildings like Simbamanyo and Lotis after their owners failed to pay their debts to commercial banks.

“Instead of avoiding risk altogether, good investors like Sudhir manage risk effectively. They diversify their portfolios across different asset classes, industries, and geographies. This approach helps mitigate losses during downturns while providing exposure to potential high-growth opportunities,” says an investment advisor.

According to economists, Sudhir’s businesses in Uganda are doing well because he does not start them without considering the opportunities available. There is talk that Sudhir is so cunning that he will go for a business that others fear, and he ends up succeeding.

Long-term vision: An expert says Sudhir as a good investor focuses on the bigger picture and avoids getting caught up in short-term noise. He understands that market fluctuations are temporary, and the true value of their investments will reveal itself over time.

Probably thus why he is serious about investment in real estate even though the market is not good right now.

Trust: Watchers of Sudhir’s rise in business say he is trustworthy to the extent that he has several business partners to deliver say construction projects

They further say that diversification ensures that his businesses support each other in many ways, including financing and office space. For instance, Crane Bank used to operate in branches owned by a sister company, Meera Investments, which is into property development.

Exposure: Unlike other Ugandan businessmen/investors, experts say Sudhir is highly exposed to international business platforms where he gains investment knowledge. This has helped him to guard himself against procuring unnecessary loans he cannot service. This is the reason why Sudhir is not in courts of law over non-payment of loans, trying to dodge paying the loans, using lawyers.

Involving and training family members in business: There is no doubt that Sudhir runs his business empire together with his family. His wife and children are serious businesspeople, who are determined to steer the Ruparelia Group of companies to greater heights, and for many generations, ahead.

Discipline: Following a well-defined investment strategy and sticking to it is crucial, Sudhir has a good investor who has resisted the temptation to chase after fads or jump on bandwagons. Their decisions are guided by a disciplined approach, preventing emotional biases from clouding their judgement.

Analytical skills: Successful investors like Sudhir possess strong analytical abilities. They conduct thorough research, scrutinizing financial statements, market trends, and economic indicators. This analytical prowess enables them to make informed investment choices.

Humility: Successful as he is, an expert says Sudhir acknowledges that he doesn’t have all the answers. “He is open to learning from their mistakes, seeking advice from experts, and adapting their strategies as needed,” he says.

Value Investing: This strategy involves identifying undervalued assets that have the potential to be appreciated in the future. Good investors seek assets trading below their intrinsic value, providing a margin of safety and potential for significant gains.

Experts say a good investor is more than just someone who generates profits. They embody a combination of traits, strategies, and a mindset that positions them for long-term success.

Patience, discipline, analytical skills, risk management, continuous learning, and a strategic approach all contribute to their ability to navigate the complex world of investing.

Ultimately, the definition of a good investor extends beyond the financial realm—it encapsulates a philosophy of prudent decision-making, resilience, and the pursuit of sustainable wealth creation.

Post Views: 23,045

Source link

The Impalaa Reports Impalaa is your biggest news source in Uganda and the East African region, bringing breaking news, daily updates, and the latest stories from Uganda.

The Impalaa Reports Impalaa is your biggest news source in Uganda and the East African region, bringing breaking news, daily updates, and the latest stories from Uganda.